Apartment REITs Rebound

Andrew Barber — February 22, 2023

When Laura Corush moved from New York to an upscale, corporate apartment complex in Miami three years ago, she was accustomed to living in a complex owned by a large company. Her final home in Manhattan was in a building operated by a public Real Estate Investment Trust (REIT).

Corush says the price of entry for renters in hot markets like South Florida is significant but worth it. “You have to pay for the convenience, of course,” she continues, “but the cost is more than offset because you avoid all of the aggravation of having to deal with problems.”

Like many new residents flocking to Miami, Corush works in the investment industry as a Managing Director at Thorofare Capital, an asset manager focused on real estate Debt Markets.

Her move is an example of the demographic shift occurring in the US as young professionals leave urban areas in the Northeast and California for booming markets in states like Florida, Texas, and the Carolinas.

Apartment building operators in low-tax Sun Belt states, including REITs, have been among the biggest beneficiaries of professionals relocating over the past decade.

REITs Rebound with 2022 in the Rear View

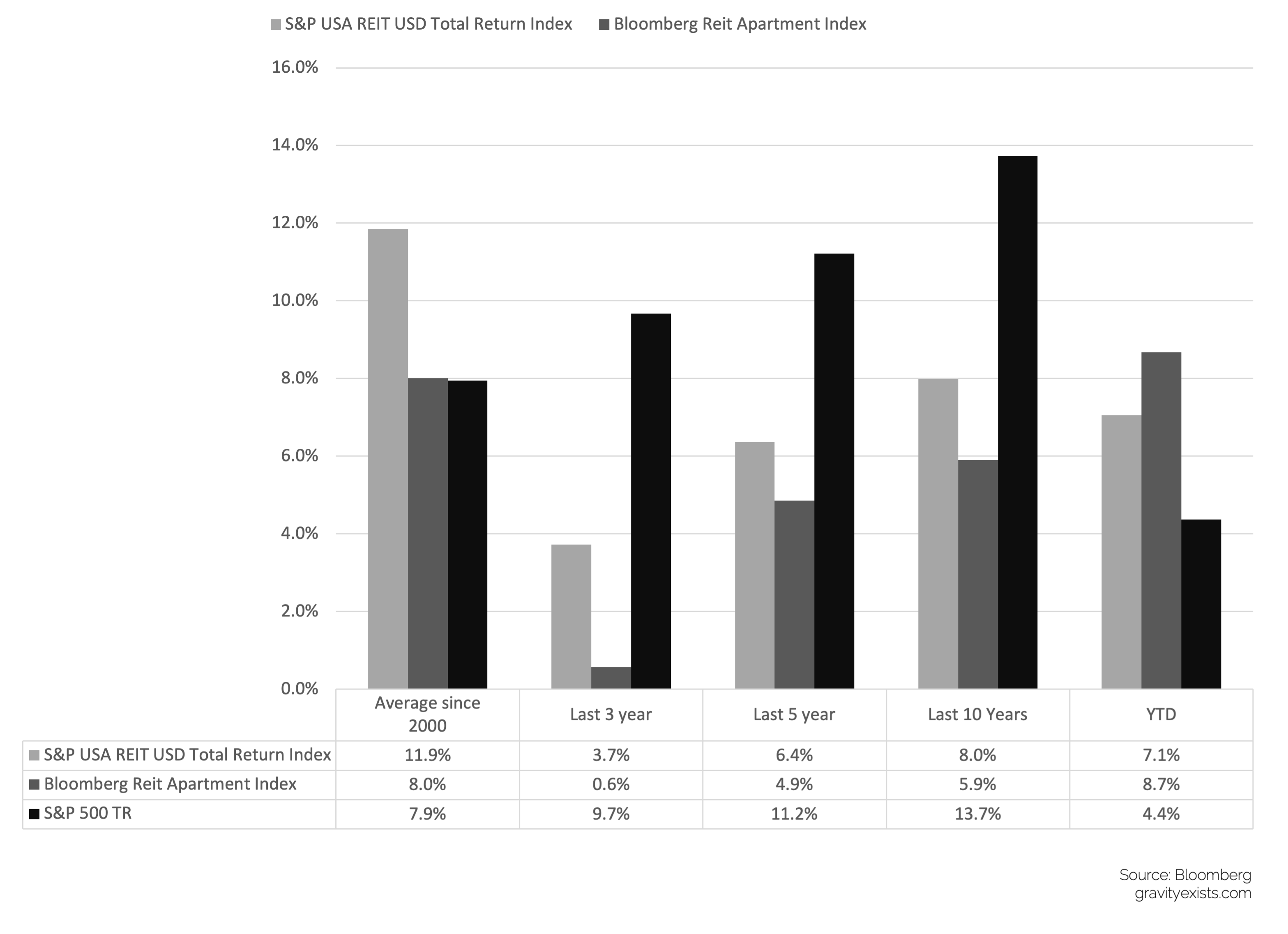

The REIT sector has been a top performer in equity markets this year, achieving the third-best January on record. As of February 14, the benchmark S&P REIT is up almost 10 percent year-to-date versus 8 percent for the S&P 500. Apartment operators have fared even better, with the Bloomberg Apartment REIT index up over 12 percent.

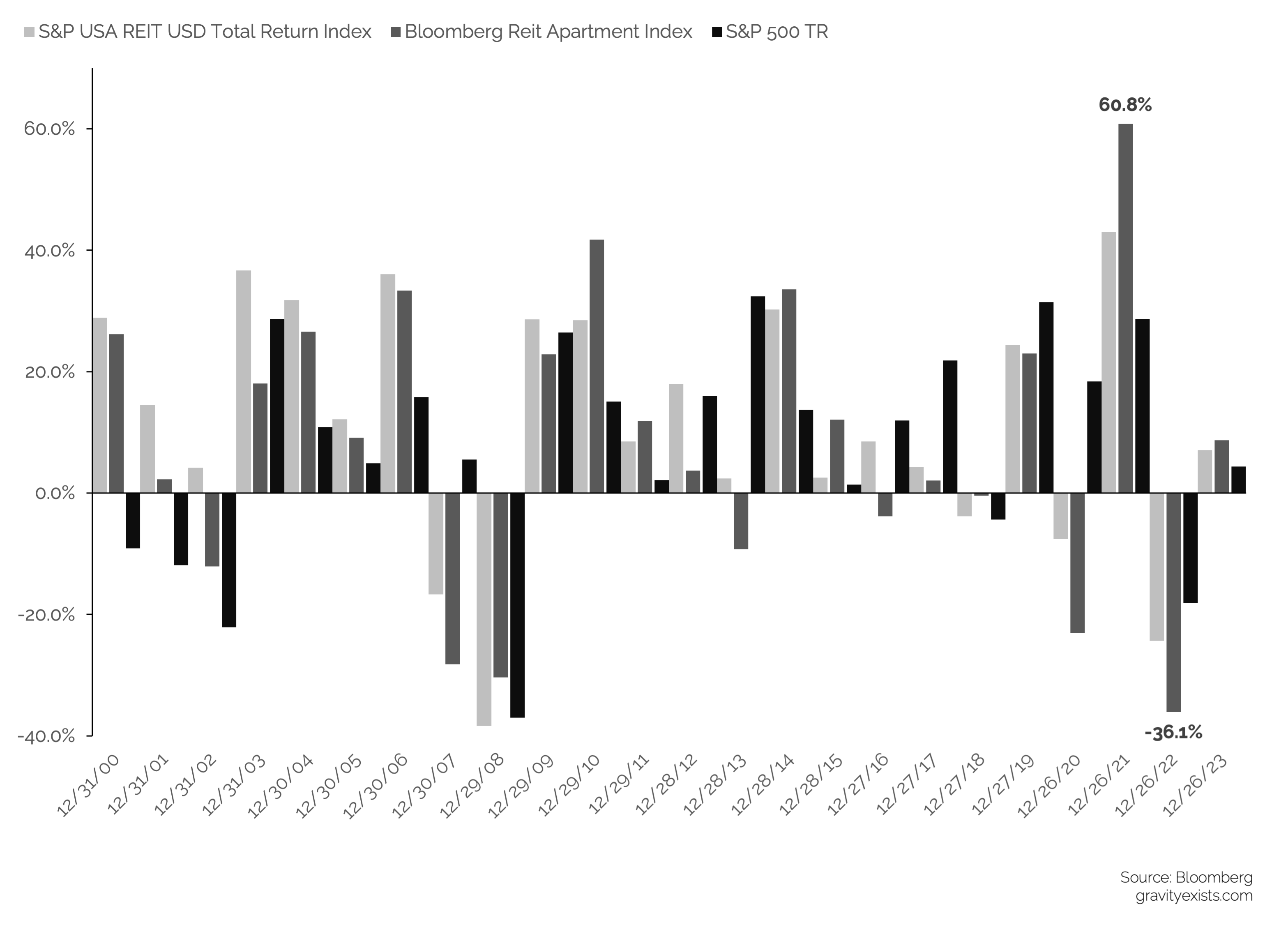

This outperformance, however, follows an apocalyptic 2022 after investor sentiment about the sector’s health soured because of rising interest rates and the possibility of recession.

Despite the sharp gains of the past six weeks, the benchmark REIT index remains down 8 percent for the last 12 months, while the apartment-specific segment is down 20 percent compared to this time last year.

For long-term investors, it’s been a harrowing experience.

“Last year was the second worst year of REIT performance since the dawn of public REITs over 30 years ago,” says Jeffrey Kolitch, Vice President and Portfolio Manager at Baron Funds. “The only year when REITs corrected more than last year was back in 2008 during the global financial crisis when REITs declined 37 percent.”

Kolitch oversees two of US News and World Report’s top five REIT mutual funds, including the Baron Real Estate Income Fund and top-ranked Baron Real Estate Fund. He contends REITs are positioned to continue to outperform the broad market for the remainder of 2023 because their fundamentals are strong compared to prior bearish cycles driven by excess leverage and overbuilding.

Not all market analysts exhibit Kolitch’s confidence. REIT analysts at Morgan Stanley are bearish on prospects for the group.

According to a report published in late January, Morgan’s team, led by Ronald Kamdem and Adam Kramer, argued that the recent rally was driven primarily by expectations that the Federal Reserve would slow the pace of rate increases.

“We think the market focus will ultimately shift back to negative earnings revisions, a potential earnings recession, as well as private valuation resetting lower,” they argued, adding, “we maintain our call for a correction in 1H23 and are fading the rally.”

Rentals Remain Resilient

The rental segment of REIT markets has been among the most volatile for the group. One explanation for this is the close association of REITs — particularly apartment operators — with shifting demographics.

During a fourth-quarter earnings call on February 2, Eric Bolton, Chairman and CEO of apartment REIT MAA reiterated the strength of the Sun Belt market that makes up a majority of its operations in 16 states.

“We are not seeing any evidence of stress with our renters in terms of collections,” he noted. “We’re not seeing any evidence of people coming in, talking about losing their job, and needing to get out their lease.”

According to Bolton, his firm continues to welcome newly arrived tenants despite economic concerns.

“Twelve percent of the leases that we did in the fourth quarter were for people moving into the Sun Belt from outside of the Sun Belt,” he said.

“I won’t be leaving anytime soon,” says Miami transplant Corush.

Rising Rents Versus Increased Supply

Because apartment REITs can increase rents over time, many investors view them as having a degree of insulation from inflation and rising interest rates.

January Consumer Price Inflation data released by the Department of Labor on February 14 illustrate this. The Owners’ Equivalent Rent (OER) segment of CPI registered at almost eight percent year-over-year versus an average rate below four percent in the years before the Covid pandemic disruptions. OER is a calculation of the rent cost equivalent to homeowners.

“One theme we’re focused on is prioritizing short-lease-duration real estate companies,” says Baron’s Kolitch. “[These] real estate companies have the ability to reprice a bit faster than long-duration real estate…to partially offset some of the inflationary headwinds.”

Rising rents and additional fees are unwelcome but not unexpected for renters in the top quintile.

“At a certain point, renting a luxury apartment is similar to owning a home with a floating rate mortgage,” says Corush. “Renting doesn’t protect you from a rising cost of capital.”

Landlords’ ability to pass costs through to tenants is subject to supply and demand. Some analysts worry excess supply from years of significant investment in the hottest markets could weaken pricing power for apartment REITs.

During a recent earnings call with analysts, MAA Chief Strategy & Analysis Officer Tim Argo noted increasing supply presents headwinds for his company in some markets.

“Austin is probably one that on the downside that we’re keeping our eye on more than anything,” said Argo, “It’s kind of got the extremes on supply and demand.”

According to Argo, four of the top 20 submarkets for increased apartment builds are in the rapidly growing Texas tech hub. “That’s one we do expect to moderate, though it does have pretty good earned in rate growth,” he said, adding, “those are a couple that we’re kind of keeping our eye on.”

In a note published last December, Goldman Sachs analyst Chandni Luthra spelled out the risk that overbuilding could indeed drag the segment.

“We think there are supply headwinds facing the Sun Belt markets, where deliveries are expected to increase significantly in 2023 after record construction activity,” Luthra wrote. “While we do not deny that the demand outlook in the Sun Belt is also more favorable, we think that with overall economic slowdown ahead — beyond just legacy tech markets given broad-based positive effects of tech activity in the last couple of years — we are more concerned about supply in these markets.”

Emily Carmichael contributed to this story.